Background

In May 2024, the Group-IB team received a request from a Malaysia-based financial organization to investigate a malware sample targeting its clients in the Asia-Pacific region.

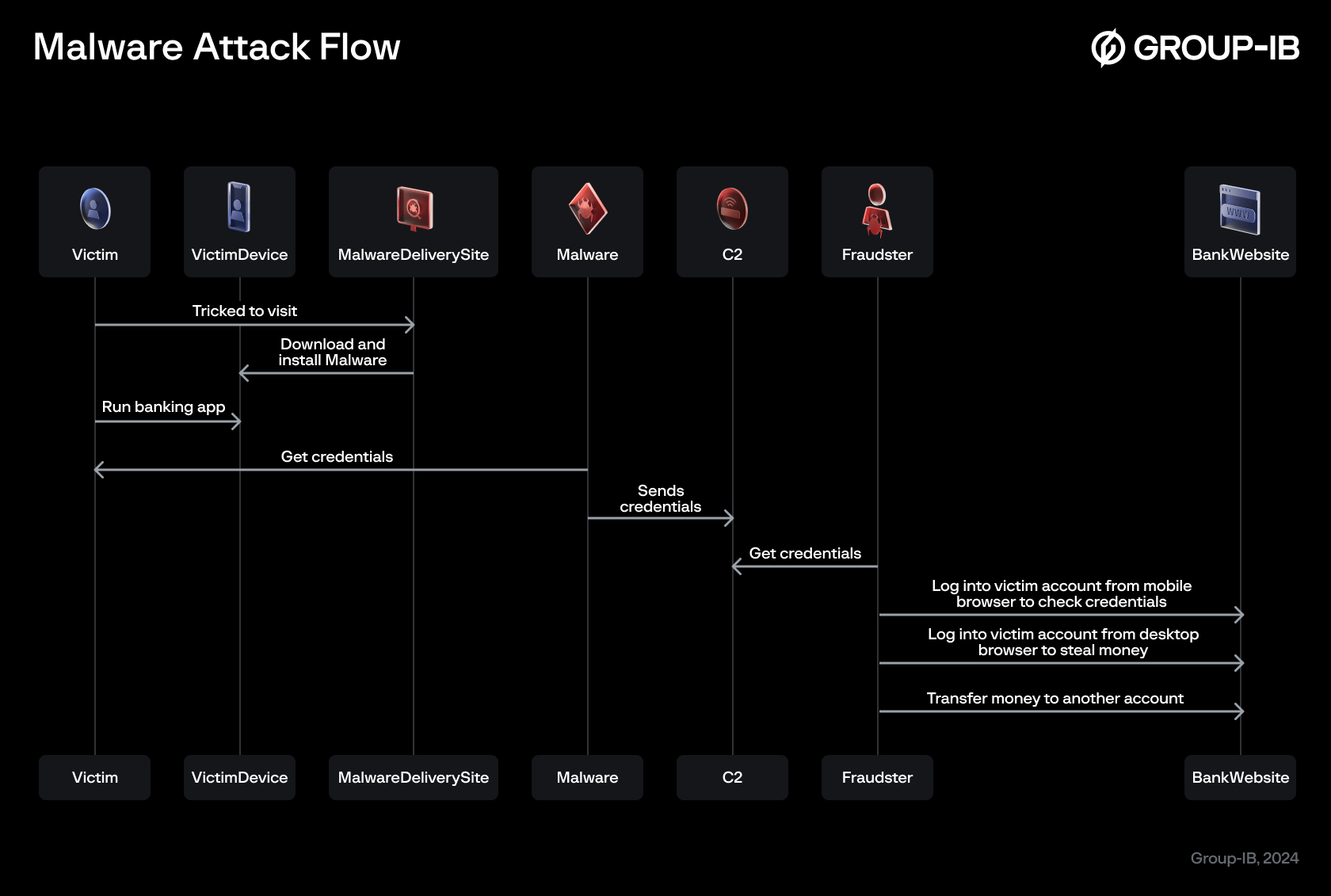

Based on details from the customer and the analysis by the Group-IB Fraud Protection team, the malware scenario was reconstructed as follows:

The victim visited a phishing website impersonating a local legitimate food brand, which prompted the victim to download an app to make a purchase. Approximately 5 minutes after downloading the app, the victim’s credentials were stolen, and experienced an unauthorized withdrawal of funds from the victim’s bank within 20 minutes of installing the app on their mobile device.

Figure 1. Example of phishing website

Figure 2. Attack Flow Diagram

After analyzing the malware sample, Group-IB Threat Intelligence experts concluded that this malware sample was attributed to the CraxsRAT.

Malware Profile

CraxsRAT is a notorious malware family of Android Remote Administration Tools (RAT) that features remote device control and spyware capabilities, including keylogging, performing gestures, recording cameras, screens, and calls. For more in-depth technical information and insights into such malware can be found in our CraxsRAT malware blog. While this Android RAT family has the capability to send SMSes to the victim’s contacts that can be used for further distribution, Group-IB’s Fraud Protection team did not observe this in use during this campaign.

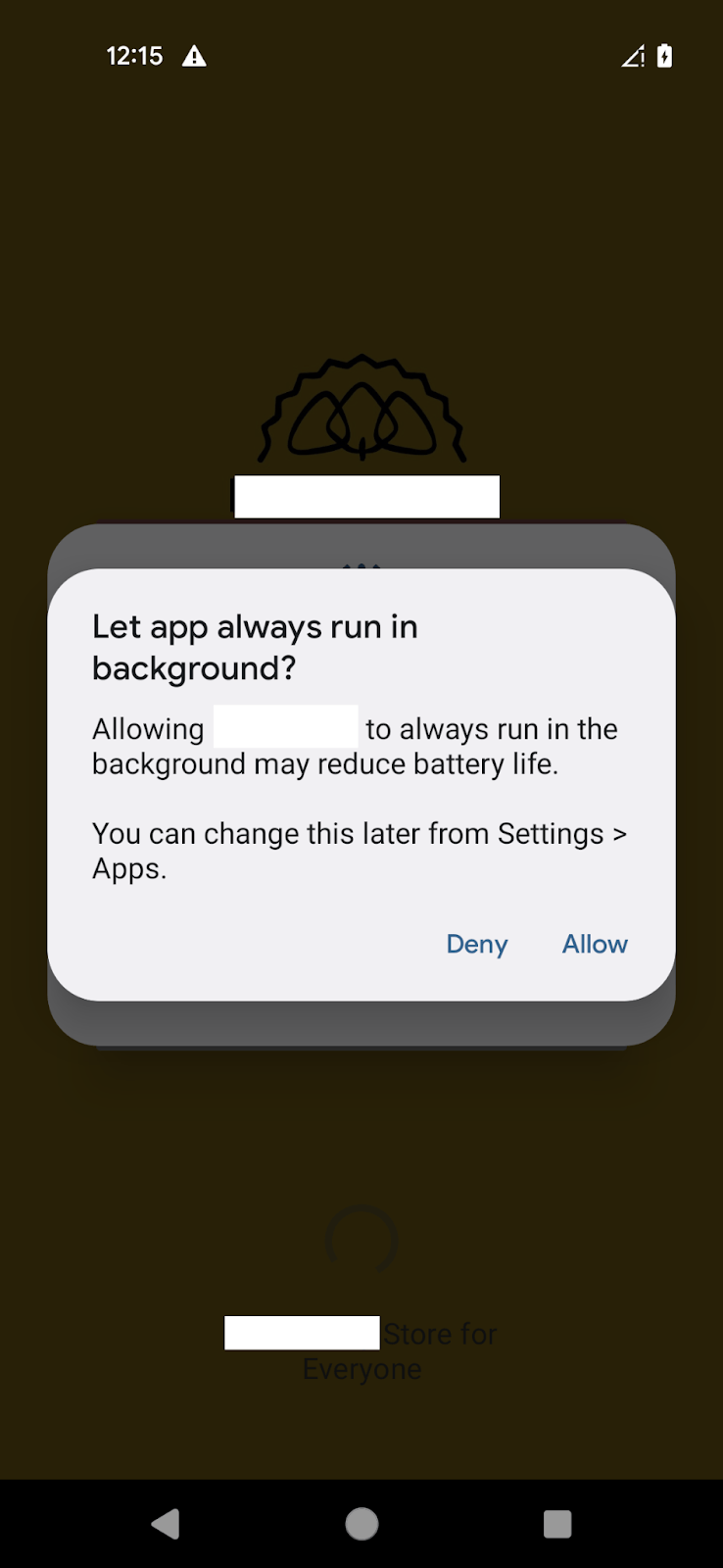

Figure 3. Trojan first screen

Scheme Target

In this campaign, CraxsRAT primarily targets banking organizations in Malaysia. Following a request from a customer, Group-IB began an investigation and found over 190 additional samples in Malaysia. They all share the same package name generation scheme and impersonated local legitimate brands within the retail services, infrastructure, food and beverages, delivery and logistics, and other consumer-oriented businesses. Brands are identified based on applications’ labels.

Impact

Victims that downloaded the apps containing CraxsRAT android malware will experience credentials leakage and their funds withdrawal illegitimately. Financial organizations targeted by CraxsRAT may experience potential damage to their brand reputation, in addition to increased compliance costs.

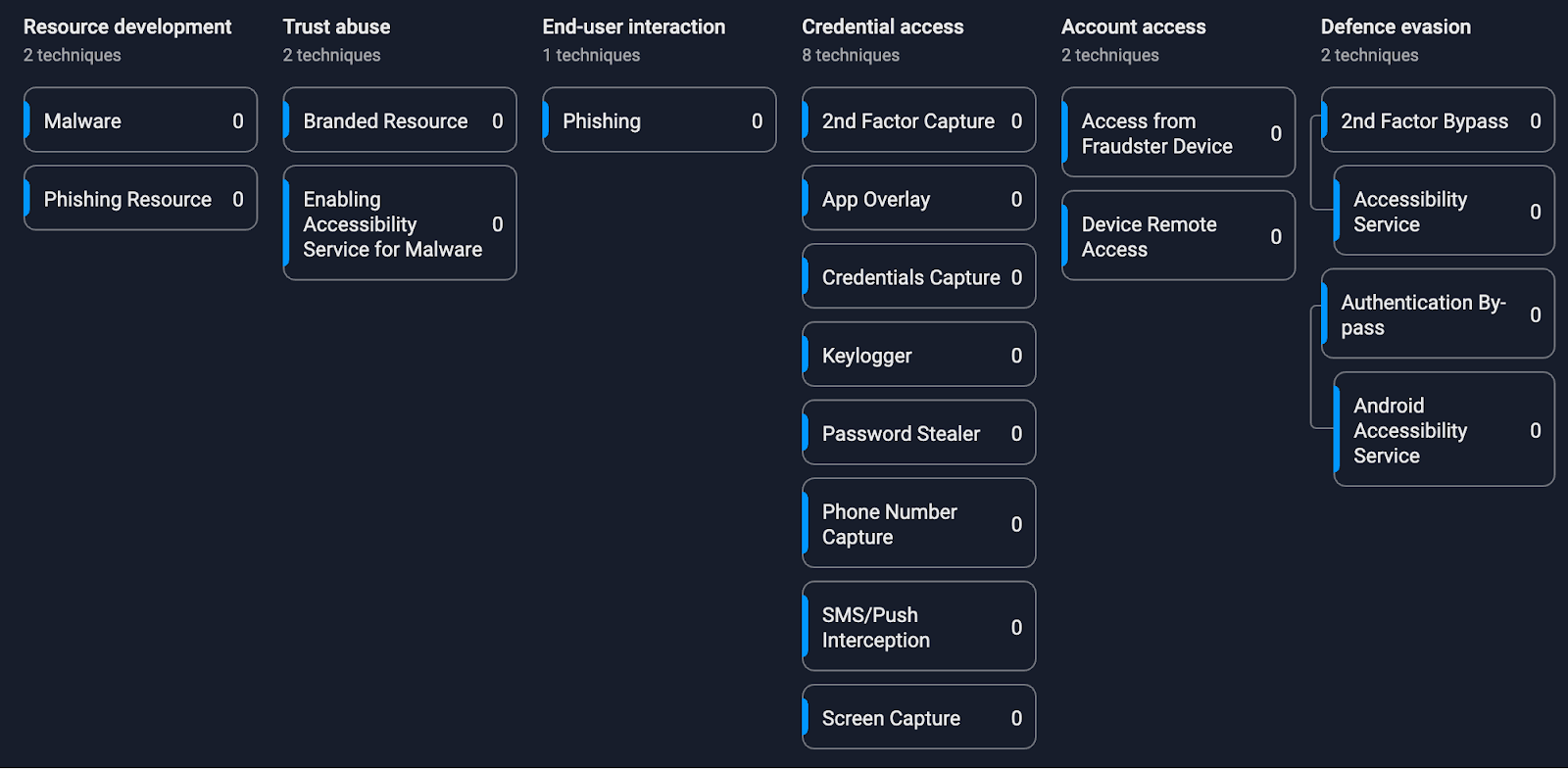

Modus Operandi

Figure 4. Fraud Matrix of this campaign

Detection and Prevention

Fraud Protection Events

To protect its clients from the threats posed by CraxsRAT android malware and similar threats, Group-IB Fraud Protection utilizes events/rules to detect and prevent CraxsRAT and other similar malware:

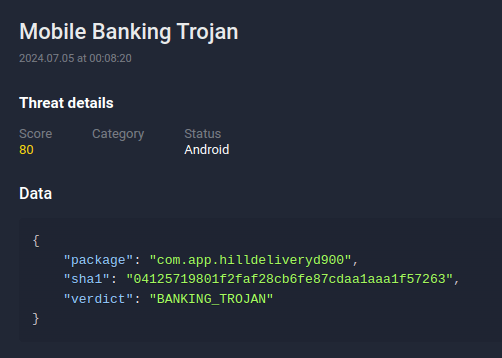

For Confirmed CraxsRAT Malware Samples

Group-IB Fraud Protection maintains a comprehensive database of all detected malware. When Fraud Protection system identifies applications from a mobile trojan list being downloaded onto an end user’s device, corresponding events would be triggered to promptly notify clients.

Figure 5. Example of “Mobile Banking Trojan”

For Ongoing Updated and New Strains – Signature-Based Detection

By analyzing the characteristics and fraudulent behavior matrix of CraxsRAT android malware, Group-IB Fraud Protection analysts develop new rules based on these shared attributes and defrauding techniques. These events target undetected or updated CraxsRAT malware samples and new strains exhibiting similar features, even without specific malware signatures.

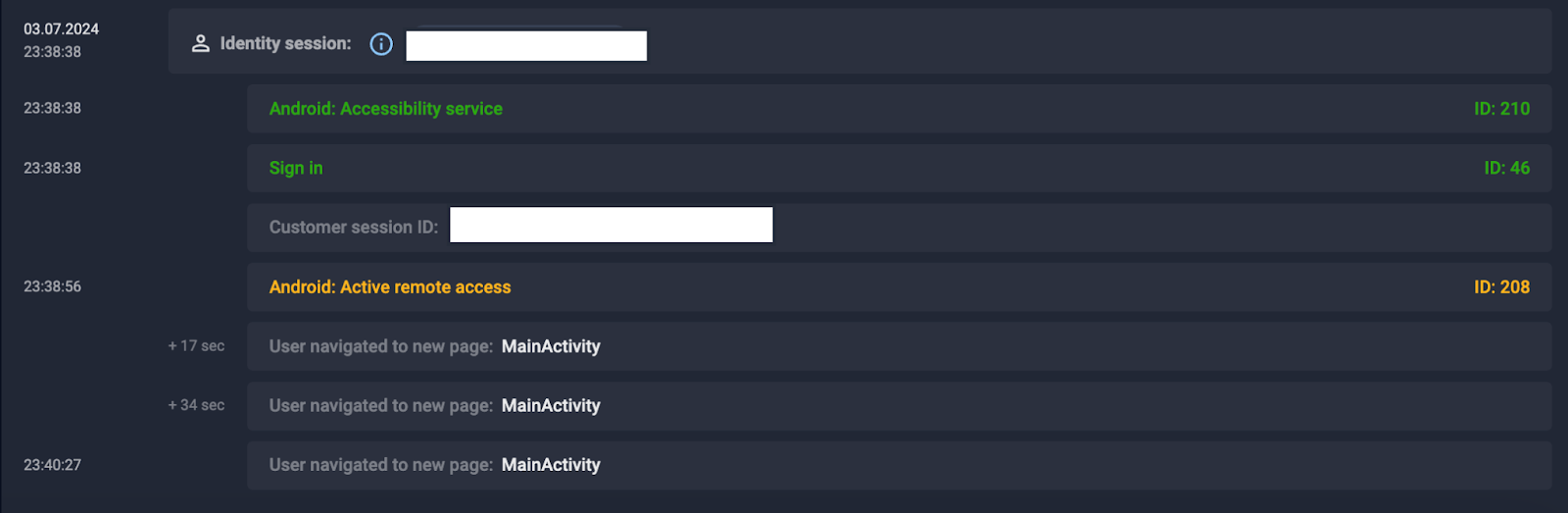

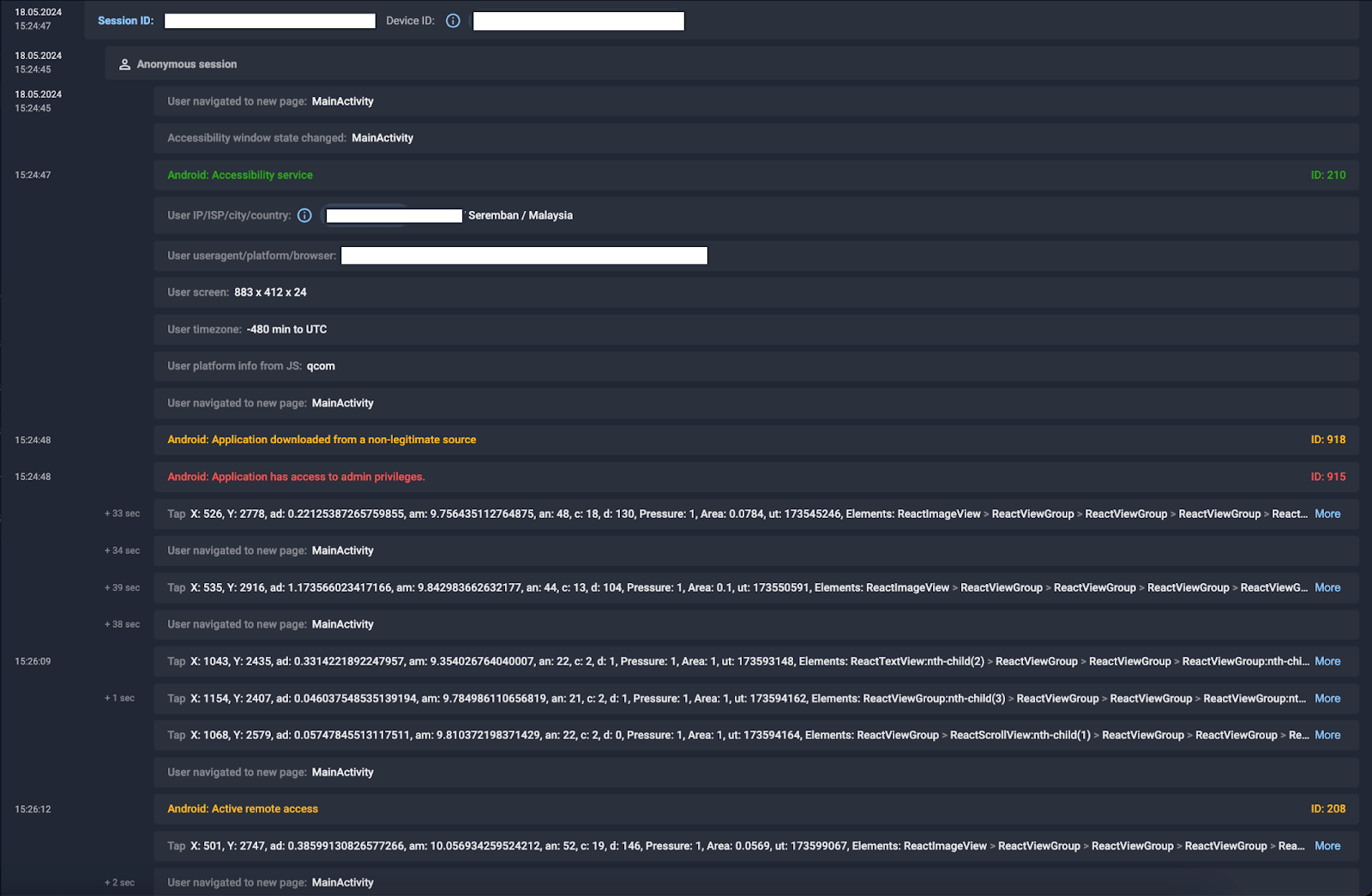

For any other fake apps – Behaviour-Based Detection

Fake apps often require end users to grant Accessibility service access and enable remote access to their Android devices upon installation. Group-IB’s Fraud Protection Platform can detect Android zero-day malware, identify non-legitimate app downloads, and monitor Accessibility service, remote access status, and parallel or overlay activity on devices. These alerts are communicated to banks, enhancing the likelihood of preventing fraudulent transactions by threat actors.

Figure 6. Example of session on infected device

Mitigation from Other Perspectives

For End Users

End-users should install mobile applications from authorized app stores such as Google Play and the Apple Store to avoid downloading fake apps containing malware. Downloading apps from third-party sites significantly increases the risk of encountering fake app scam. Additionally, users should exercise caution when clicking suspicious buttons or links found on unknown websites or in emails to avoid unintentional granting high-privilege access to fraudsters and the potential loss of credentials.

For banking organizations

Banking organizations play a pivotal role in safeguarding their customers’ financial information. It is imperative for banks to educate customers about security best practices and promote proactive behavior. This includes advising customers to install mobile banking apps only from authorized app stores, avoid clicking on suspicious links, and regularly monitor their accounts for unusual activity. Additionally, banks should implement multi-factor authentication, real-time fraud detection systems, and provide timely alerts to customers regarding potential security threats. By fostering a culture of security awareness, banking organizations can significantly reduce the risk of fraudulent transactions and enhance overall trust in their services.

Conclusion

CraxsRAT malware allows fraudsters to remotely access a victim’s device and steal credentials, leading to financial loss. In addition, CraxsRAT malware is rapidly evolving, with a dramatically increasing number of new strains emerging each day. To build a multi-dimensional detection method for identifying sessions with confirmed malware samples or emerging new strains, the following events are recommended for clients of the Fraud Protection system:

- Events – Signature-based detection: Fraud Protection can detect the mobile trojan and suspicious mobile application. These events facilitate the detection of confirmed malware samples, mobile trojans listed in the Fraud Protection trojan list, and any suspicious mobile applications.

- Events – Behavior-based detection: Fraud Protection can detect Android zero-day malware, identify non-legitimate app downloads, and monitor Accessibility service, remote access status, and parallel or overlay activity on devices. These events enable the detection of emerging malware strains by analyzing their behaviors.

- Events – Statistic-based detection: Fraud Protection can detect changes in user provider, high-risk ISPs, and IPs from high-risk countries. These events help identify suspicious IPs, subnets, and countries linked to known frauds or malwares, serving as informative notifications or as part of a combination of events to prevent fraudulent activity.

- Events – Cross-department detection: In cooperation with Threat Intelligence, Fraud Protection can detect compromised user login. These events enable the tracking of activities of users whose accounts have been compromised, serving as user notifications or as part of a combination of events to prevent fraudulent activity.